Uk Capital Gains Tax Rates 2025 2025. The uk budget 2025's adjustments to capital gains tax (cgt) are not merely technical tax reforms; For the 2025 to 2025 tax year the allowance is £3,000, which leaves £9,600 to pay tax on.

The capital gains tax rate you use depends on the total amount of your taxable income, so work that out first. Previously, gains from debt funds held for over.

The capital gains tax rate you use depends on the total amount of your taxable income, so work that out first.

Capital Gains Tax 2025 Gov Uk Wendy Joycelin, Capital gains tax rates & allowances. Regardless of the holding period, these gains are taxed at income tax rates.

Uk Capital Gains Tax Allowance 2025/25 Shana Danyette, Private equity execs are eyeing the exits as labour plots to close capital gains loophole. The capital gains tax rate you use depends on the total amount of your taxable income, so work that out first.

Capital Gains Tax Allowance 2025/24 Uk Emlyn Iolande, Basic rate taxpayers pay 10% (or 18% for residential property), while higher and additional rate taxpayers pay 20% (or 28% for residential property) on gains above the aea. The present provisions of determining capital gains tax are complex and varied.

Tax Tables 2025 Irs For Capital Gains Vanda Miranda, Whereas, if you think sdlt rates or house prices or interest rates may come down, then there is scope to delay a property purchase until 2025. The chancellor of the exchequer has made several announcements concerning rates and allowances applying from 6 april 2025, including the continued freezing of several key tax thresholds and reductions in the amount of annual exempt dividends and capital gains each taxpayer is allowed.

Capital Gains Rate 2025 Table Image to u, There are two different rates of capital gains tax. For 2025/25, the higher rate of property capital gains tax will be reduced from 28% to 24%, chancellor jeremy hunt announced in his budget of 6 th march.

Capital Gains Tax Rate 2025/25 Calendar Donica Rodina, Any excess gains are taxed at 20%. Managers to pay capital gains tax of 28c on profits.

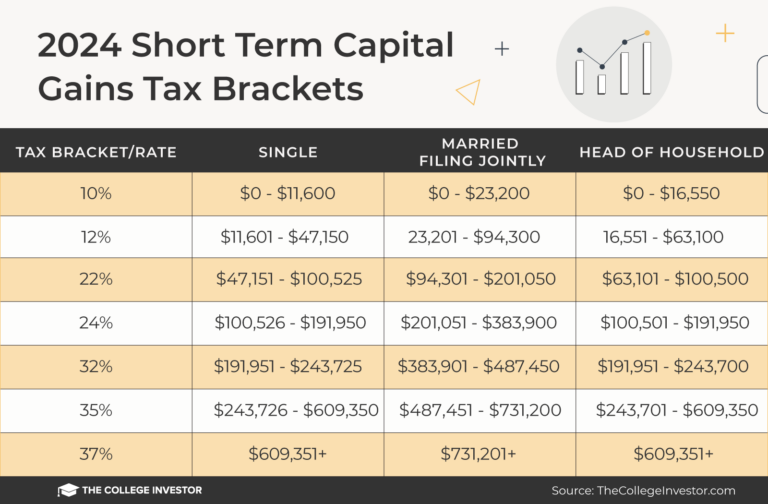

Capital Gains Tax Brackets And Tax Tables For 2025, Rates for capital gains tax. Regardless of the holding period, these gains are taxed at income tax rates.

Capital Gains Tax Rates How To Calculate Them And Tips On How To My, Capital gains tax annual exempt amount for individuals: There are two different rates of capital gains tax.

ShortTerm And LongTerm Capital Gains Tax Rates By, For example, if you fear capital gains rates may increase, then there is a window of opportunity to crystallise gains under the current regime. There are two different rates of capital gains tax.

Capital Gains Tax Comparison UK and Ireland Chartered Accountants, The uk budget 2025's adjustments to capital gains tax (cgt) are not merely technical tax reforms; How much is capital gains tax?